Evaluez et valorisez votre entreprise ou votre projet

Startup en levée de fonds ou entreprise en phase de cession ou acquisition, Estimeo met à disposition ses outils d’évaluation pour les fondateurs et dirigeants d’entreprises, ceux qui les financent et ceux qui les accompagnent.

Obtenez gratuitement et en 1 minute une première fourchette de valorisation

Pourquoi valoriser votre entreprise ?

Startups

- Recherche de financement

- Entrée/Sortie d'un associé

- Connaître la valeur de son entreprise

- Mesurer les progrès

- Ajuster sa stratégie

- Négociations

- Evaluer sa position face au paysage concurrentiel

- BSPCE

TPE/PME

- Accès au financement

- Cession de l'entreprise

- Fusion et acquisition de l'entreprise

- Nouveaux partenaires et/ou actionnaires

- Réévaluation des actifs

- Stratégies fiscales et comptables

- Résolution des conflits

- Vente ou création d'actions

Faites appel à un conseiller pour trouver le produit adapté à votre besoin !

Nous les avons accompagné

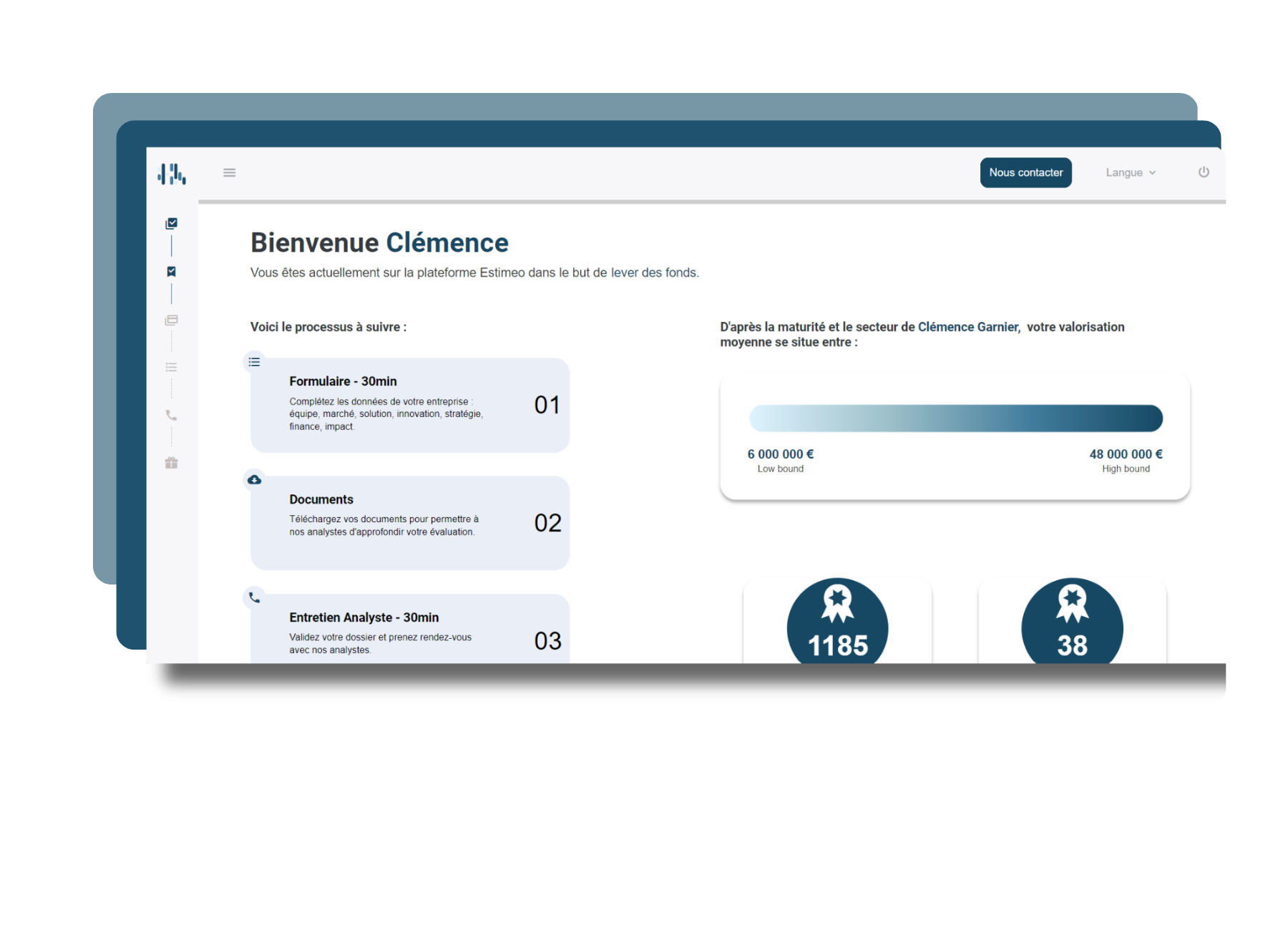

La valorisation de votre entreprise en accélérée

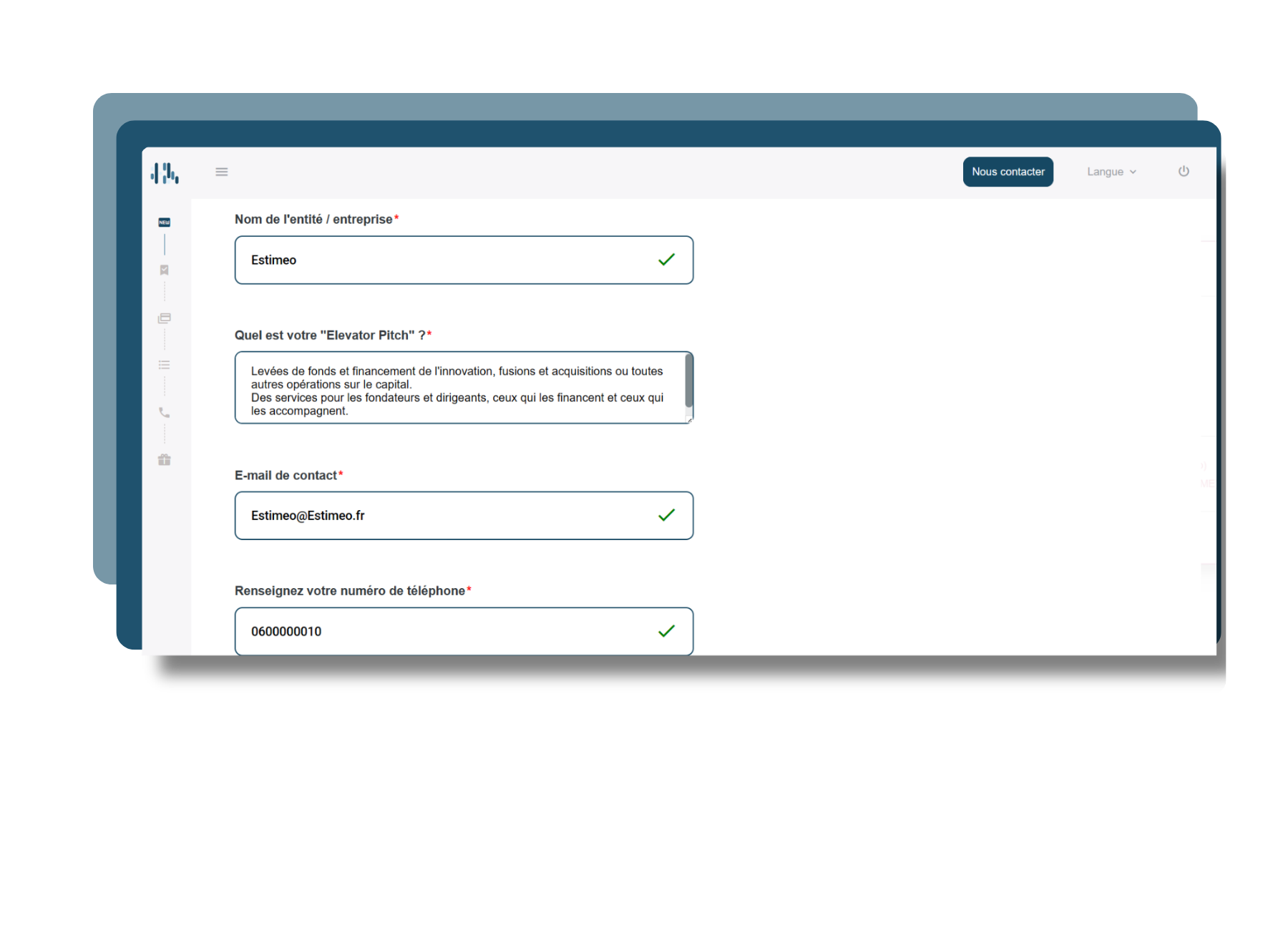

Avec la plateforme Estimeo, nous avons transformé l’approche traditionnelle de la valorisation d’entreprise.

En intégrant une technologie algorithmique de pointe liée à l’intelligence artificielle, une base de données sectorielles exhaustive et l’analyse d’experts, nous proposons une solution unique pour l’évaluation de startups, TPE et PME.

Notre processus garantit une analyse transparente et précise, offrant ainsi à nos clients une vision claire et fiable de la valeur de leur entreprise.

Nos offres

Nous mettons à votre disposition divers outils pour évaluer votre entreprise et optimiser votre stratégie de financement.

Notation UGAP

Faites-vous référencer par l’UGAP grâce à notre rapport de notation certifié

Levées de fonds

Bénéficiez d’un accompagnement sur-mesure pour réaliser votre tour de table

Cessions - Acquisitions

Profiter d’un accompagnement personnalisé pour la cession ou acquisition d’une entreprise