Valuation adapted to VSEs/SMEs

Are you thinking of buying or selling a company?

Do you want to sell shares or make an investment?

Are you looking for financing?

Or any other capital transaction…

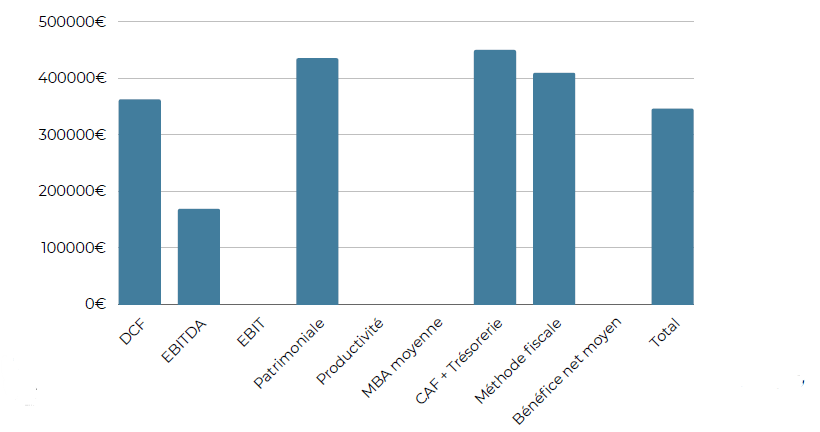

We use a combination of methodologies and financial comparables to provide you with an accurate valuation of your business.

A 5-stage recovery process

Use the platform to assess the fair value of your company on the market, so that you can prepare and orchestrate your capital transactions.

Discover our offers

Accelerated valuation

459€ HT

Delivery within 48 hours

INCLUDED

- Refining your financing strategy

- Meet investor

- Negotiating your fundraising

- Comparables and discounted multiples

- 9 valuation methods

- Valuation range

- Precise valuation

- Methods in detail

- Financial appendices

- Appointment with analyst included

Certified valuation

859€ HT

Delivery within 7 working days

INCLUDED

- Refining your financing strategy

- Meet investors

- Negotiating your fundraising

- Setting up BSPCEs

- Setting up US SAFE

- Launching an M&A operation

- Comparables and discounted multiples

- 9 valuation methods

- Valuation range

- Precise valuation

- Methods in detail

- Financial appendices

- Appointment with analyst included

- Verified declarative data

Valuation reports adapted to VSEs and SMEs

The valuation of a company is based primarily on its established financial history. This valuation focuses on current and past financial performance, while requiring the consideration of multiple extra-financial factors for optimum precision.

Recognised by financial institutions

Reliable and accurate valuation

Up to 7 methods applied

Extra-financial analysis and weighting