Valuation developed for start-ups

Are you preparing to raise funds?

Do you want to assess the value of a company?

Do you want to sell shares or make an investment?

Do you want to buy or sell a company?

More than 4,000 valuations: Benefit from Estimeo’s expertise in financial and non-financial analysis

A 5-stage recovery process

Use the platform to assess the fair value of your start-up on the market, so that you can prepare and orchestrate your capital transactions.

Discover our offers

Accelerated valuation

459€ HT*

Pré-revenue

INCLUDED

- Refining your financing strategy

- Meet investors

- Negotiating your fundraising

- Comparables and discounted multiples

- 7 valuation methods

- Valuation range

- Precise valuation

- Methods in detail

- Financial appendices

- Analyst appointment included

Certified valuation

859€ HT

Post-revenue

INCLUDED

- Refining your financing strategy

- Meet investors

- Negotiating your fundraising

- Setting up BSPCEs

- Setting up Air warrants

- Launching an M&A operation

- Comparables and discounted multiples

- 7 valuation methods

- Fourchette de valorisation

- Precise valuation

- Methods in detail

- Financial appendices

- Analyst appointment included

Diagnostic Growth

5000€ HT*

*50% financed by Bpifrance

- Business plan

- Pitch deck

- Certified valuation

- Investor relations

- Pitch training

Valuation reports tailored to start-ups

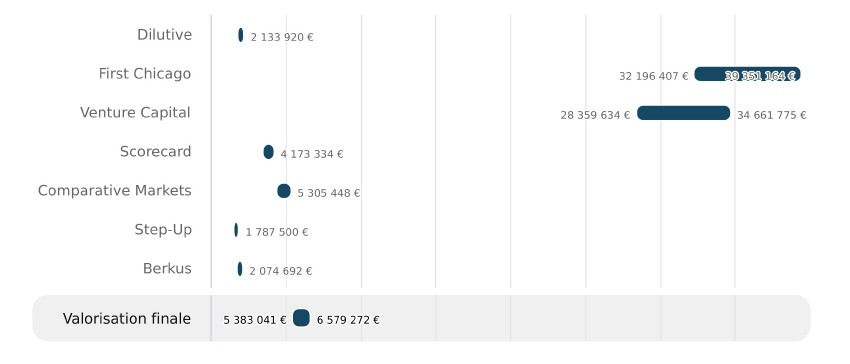

Our analysis highlights the intangible factors by focusing on 7 pillars: People, Market, Strategy, Offer, Finance, Innovation and Impact, in order to assess each start-up accurately and precisely.

Recognised by financial institutions

Reliable and accurate valuation

Up to 7 methods applied

Extra-financial analysis and weighting

We have enhanced their value